rhode island income tax rate 2021

RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. If you make 75000 a year living in the region of Rhode Island USA you will be taxed 12418.

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

The table below shows the income tax rates in Rhode Island for all filing statuses.

. Calculations are estimates based on tax rates as of Dec. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Exemption Allowance 1000 x Number of Exemptions.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. These rates are subject to change. Interest on overpayments for the calendar year 2021 shall be at the rate of three and one-quarter percent 325 per annum.

Rhode Island Tax Brackets for Tax Year 2021. Ad Compare Your 2022 Tax Bracket vs. Your average tax rate is 1758 and your.

The changes were made to the Rhode Island. Rhode Island also has a 700 percent corporate income tax rate. 2021 and data from the Tax Foundation.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Complete Edit or Print Tax Forms Instantly. Detailed Rhode Island state income tax rates and brackets are available on.

The Federal or IRS Taxes Are Listed. In Rhode Island theres a tax rate of 375 on the first 0 to 66200 of income for single or married filing taxes separately. Your average tax rate is 1651 and your.

The Division of Taxation has posted the income tax rate schedule for 20 22 that will be used by fiduciaries for many trusts and estates. Ad Access IRS Tax Forms. Uniform rate schedule The Division of Taxation has recalculated tax bracket ranges for tax year 2021 as required by statute.

Rhode Island Income Tax Calculator 2021. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Your 2021 Tax Bracket to See Whats Been Adjusted.

Rhode Island Income Tax Calculator 2021. Detailed Rhode Island state income tax rates and brackets are available on. The rate so set will be in effect for the calendar year 2021.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. 2021 Tax Year Return. Discover Helpful Information and Resources on Taxes From AARP.

If you make 140000 a year living in the region of Rhode Island USA you will be taxed 32198. Rhode Island has a. Outlook for the 2023 Rhode Island income tax rate is to remain unchanged with income tax brackets increasing due to the annual inflation adjustment.

If you make 120000 a year living in the region of Rhode Island USA you will be taxed 26200. Rhode Island Income Tax Calculator 2021. If youre married filing taxes jointly theres a tax rate of 375.

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by. Rhode Island Income Tax Calculator 2021. Any income over 150550 would be.

Rhode Island Income Tax Calculator 2021. Income tax rate schedule. The Rhode Island Tax Calculator Lets You Calculate Your State Taxes For the Tax Year.

The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income. Apply the taxable income computed in step 5 to the following. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

However if Annual wages are more than 231500 Exemption is 0. Income Tax Sales Tax Fuel Tax Property Tax. DO NOT use to.

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the. Your average tax rate is 1198 and your. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Total Estimated 2021 Tax Burden. Your average tax rate is 1265 and your.

Labor Market Information Ri Department Of Labor Training

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Calculator Smartasset

Rhode Island Paycheck Calculator Tax Year 2022

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Brackets 2020

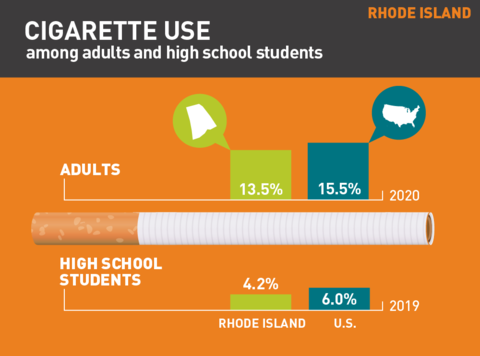

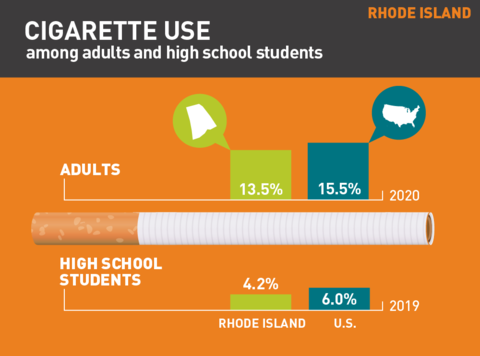

Tobacco Use In Rhode Island 2021

Is Shipping Taxable In Rhode Island Taxjar

Rhode Island State Economic Profile Rich States Poor States

Where S My Refund Rhode Island H R Block

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Estate Tax Everything You Need To Know Smartasset

How To Set Up An Llc In Rhode Island 2022 Guide Forbes Advisor